How to Set Up WooCommerce Tax Plugin for Accurate Tax Calculations

Table of Contents

- What is the WooCommerce Tax Plugin?

- Why is WooCommerce Tax Management Important?

- How the Plugin Simplifies WooCommerce Tax Setup

- Who Can Benefit from This Plugin?

- Key Features & Benefits of WooCommerce Tax Plugin

- How to Set Up WooCommerce Tax Plugin

- Why Use WooCommerce Tax Plugin?

- Conclusion

What is the WooCommerce Tax Plugin?

The WooCommerce Tax Plugin is an official solution for handling taxes in WooCommerce stores. It automates tax calculations, removing the need for manual tax setup. Based on the location of the consumer, the plugin guarantees proper WooCommerce sales tax. It helps store owners comply with tax laws effortlessly.

Why is WooCommerce Tax Management Important?

One of the most important aspects of operating an internet business is handling taxes. Different regions have different tax rules, including state, local, and international taxes. Manual tax setup can lead to errors, compliance issues, and even penalties. The WooCommerce tax plugin makes tax collection simple, accurate, and automated.

How the Plugin Simplifies WooCommerce Tax Setup

Setting up taxes manually in WooCommerce can be time-consuming. Store owners need to research WooCommerce tax rates and enter them correctly. The WooCommerce Tax Plugin eliminates this hassle. It fetches real-time tax rates and applies them at checkout. Businesses that sell in several regions will find this option helpful.

Who Can Benefit from This Plugin?

- Small Business Owners – Save time by automating WooCommerce tax calculations.

- International Sellers – Easily handle VAT and other global tax rules.

- Dropshipping Stores – Ensure correct taxes are applied based on customer location.

- Subscription-Based Businesses – Maintain compliance for recurring payments.

Key Features & Benefits of WooCommerce Tax Plugin

The WooCommerce Tax Plugin simplifies tax management by automating tax calculations. It ensures accuracy and compliance with local and international tax laws. The main attributes and advantages that make this plugin indispensable for owners of WooCommerce stores are listed below.

- Automated Tax Calculations

Manual tax calculations can be time-consuming and prone to errors. This procedure is automated by the WooCommerce Tax Plugin, guaranteeing precise tax collection at checkout. It calculates WooCommerce sales tax based on customer location, eliminating guesswork. Businesses who sell in several states or nations will find this function very helpful.

How It Works:

- The customer’s billing or shipping address is detected by the plugin.

- It applies the correct WooCommerce tax rates automatically.

- No need to manually update rates when tax laws change.

This automation saves time and ensures tax compliance without additional effort.

- Seamless Compliance with Tax Laws

Different regions have different tax laws, making compliance challenging. The WooCommerce tax plugin helps businesses follow state, local, and international tax rules. It supports VAT, GST, and U.S. WooCommerce sales tax, making it a global solution.

Why This Matters:

- Prevents legal issues related to incorrect tax collection.

- Supports granting qualified clients tax exemptions.

- Without requiring manual updates, it adjusts to evolving tax laws.

With built-in compliance features, businesses can avoid penalties and focus on growth.

- Real-Time Tax Rate Updates

Tax rates change frequently, making manual updates difficult. The WooCommerce Tax Plugin fetches real-time rates from trusted sources. Customers will always pay the correct amount of taxes thanks to this.

Key Benefits:

- Automatically updates WooCommerce tax settings with current rates.

- Minimizes mistakes in the tax computations at the point of sale.

- Removes the need for data entry and manual research.

Accurate tax rates help build customer trust and prevent unexpected tax liabilities.

- Easy Integration & Setup

Setting up tax rules manually in WooCommerce can be complex. The WooCommerce Tax Plugin integrates seamlessly without requiring technical knowledge. Once activated, it works automatically without additional configurations.

Setup Highlights:

- No coding or advanced settings required.

- Works alongside other WooCommerce tax management tools.

- Compatible with different product types and shipping options.

It is perfect for novice and seasoned store owners alike because of its simple setup.

- Handles Complex Tax Scenarios

There are several tax rates and exemptions that some firms must deal with. The WooCommerce Tax Plugin supports these complexities with built-in flexibility. It manages different WooCommerce tax calculations for various regions and products.

Supported Tax Scenarios:

- Different tax rates based on product category (e.g., food, electronics).

- Tax exemptions for specific customers or locations.

- Multi-state and international sales tax calculations.

With these features, the plugin ensures tax accuracy for all business types.

How to Set Up WooCommerce Tax Plugin

The WooCommerce Tax Plugin makes tax management simple by automating tax calculations. Even for people who are not technical, setting it up is simple. To activate and set up the plugin for precise WooCommerce tax computations, follow these instructions.

Step 1: Install and Activate the WooCommerce Tax Plugin

You must install and activate the plugin before you can use it. This step ensures your store is ready for WooCommerce automated tax calculation.

How to Install:

- Open your WordPress dashboard and log in.

- Navigate to Plugins > Add New and look up “WooCommerce Tax.”

- After selecting Install Now, the plugin will be activated.

Once activated, the plugin will integrate with your WooCommerce tax settings automatically.

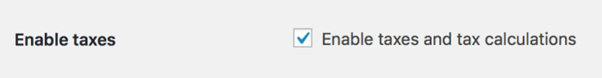

Step 2: Enable Automated Tax Calculations

After activation, you need to enable automatic tax calculations. This setting ensures your store applies the correct WooCommerce tax rates for each sale.

How to Enable Taxes in WooCommerce:

- Select General under WooCommerce > Settings.

- Locate the Enable Taxes option by scrolling down.

- Click “Save Changes” after checking the box.

Now, tax options will be available in your WooCommerce settings.

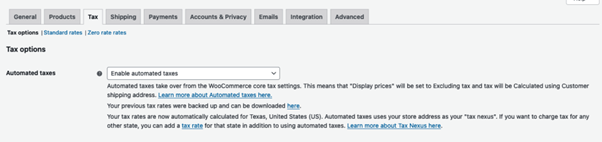

Step 3: Configure WooCommerce Tax Settings

Once taxes are enabled, configure the plugin to suit your business needs.

Steps to Configure Tax Settings:

- Navigate to WooCommerce > Settings > Tax.

- Choose how prices are displayed (inclusive or exclusive of tax).

- Choose the tax calculation method (depending on the billing or delivery address of the consumer).

- Enable WooCommerce tax integration for automated tax rates.

- To apply the changes, click Save Changes.

These choices assist in tailoring tax laws according to your business type and geographic area.

Step 4: Test Tax Calculations at Checkout

Before launching your store, test the tax setup to ensure accuracy.

How to Test:

- Add a product to your cart.

- Enter different shipping addresses to check tax changes.

- Verify the tax amount displayed at checkout.

If the tax does not calculate correctly, revisit your WooCommerce tax settings and make adjustments.

Why Use WooCommerce Tax Plugin?

The WooCommerce Tax Plugin helps store owners manage taxes effortlessly. Its ensures precise tax collection at checkout by automating WooCommerce tax computations. These are the main justifications for why your company needs this plugin.

- Saves Time with Automated Tax Calculations

Manual tax setup requires research, entry, and constant updates. The WooCommerce Tax Plugin eliminates this workload by automating tax rates. It instantly applies the correct WooCommerce sales tax based on customer location.

Benefits:

- No need to manually update WooCommerce tax rates.

- Automatically adjusts to tax law changes.

- Works for both local and international tax rules.

Business owners can now concentrate on sales rather than tax administration thanks to its technology.

- Reduces Errors in Tax Collection

Incorrect tax calculations can lead to compliance issues and customer disputes. The plugin ensures accurate WooCommerce tax compliance by applying the correct rates.

How It Helps:

- Prevents overcharging or undercharging taxes.

- Ensures compliance with state and country-specific tax laws.

- Reduces manual entry mistakes.

Accurate tax collection builds trust and improves the shopping experience.

- Ensures Compliance with Changing Tax Laws

Tax regulations frequently change, making manual updates challenging. The WooCommerce tax integration keeps your store compliant by fetching real-time rates.

Key Compliance Features:

- Supports VAT, GST, and U.S. sales tax rules.

- Automatically applies region-based tax rates.

- Adapts to tax rule changes without store owner intervention.

This feature ensures your business stays legally compliant without extra effort.

- Works Seamlessly with WooCommerce

The plugin integrates directly with WooCommerce tax settings, requiring minimal setup. It works with various product types, shipping options, and payment methods.

Why This Matters:

- No coding or manual setup needed.

- Works with both digital and physical products.

- Supports tax exemptions for eligible buyers.

This flexibility makes tax management hassle-free for all types of online stores.

Conclusion

The WooCommerce Tax Plugin makes tax management easy and stress-free. It ensures precise tax collection at checkout by automating WooCommerce tax computations. With real-time updates, businesses stay compliant with changing tax laws. The plugin streamlines tax settings, cuts down on errors, and saves time. Whether selling locally or internationally, it ensures smooth WooCommerce tax management.

Need Help? Here’s the Support Process

WooCommerce offers official support for the WooCommerce Tax Plugin. If you face issues, follow these steps:

- Check Documentation – Visit WooCommerce’s support page for setup guides.

- Submit a Ticket – Contact WooCommerce support for direct assistance.

- Community Forums – Get help from other WooCommerce users.

Still Facing Issues? WooHelpDesk is Here!

If problems persist, WooHelpDesk provides expert support for WooCommerce. Our team helps with WooCommerce tax setup, troubleshooting, and advanced configurations. Get in touch with us for prompt, dependable help.